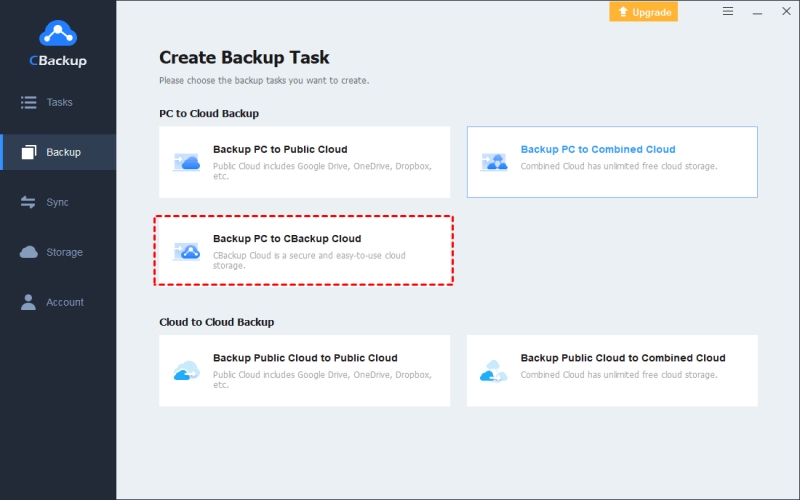

Free Online Backup Software: Backup Your Files Online Easily

Should I Use Online Backup? While data security is more important than ever, many individuals and organizations still don't have a comprehensive data backup and recovery strategy. This could be a... Read More »

Do You Want to Be a More Likeable Person?

Being likeable is a good thing! It means you're easy to get along with, pleasant to be around, and generally well-received by other people. It usually involves things like friendliness,... Read More »

Salesforce CPQ: Transforming the Sales Landscape

Have you ever wondered how businesses manage to customize, price, and quote their vast array of products and services so effectively? The answer lies in a tool called CPQ and one of the most powerful... Read More »

Plan A Private Dinner For...

The enjoyment you derive from your trip will largely rely on how you explore this... Read More »

RFP for Consulting Servic...

When creating an RFP for consulting services, there are a number of things that you... Read More »